In 2025, coin deposit machines (CoDMs) have become an essential part of modern banking and retail systems, offering a seamless way to manage loose change and improve currency circulation. As digital payments continue to dominate, these machines provide a bridge between traditional cash transactions and the evolving financial landscape.

More trending topic: Controversy About Karim Khan 2025

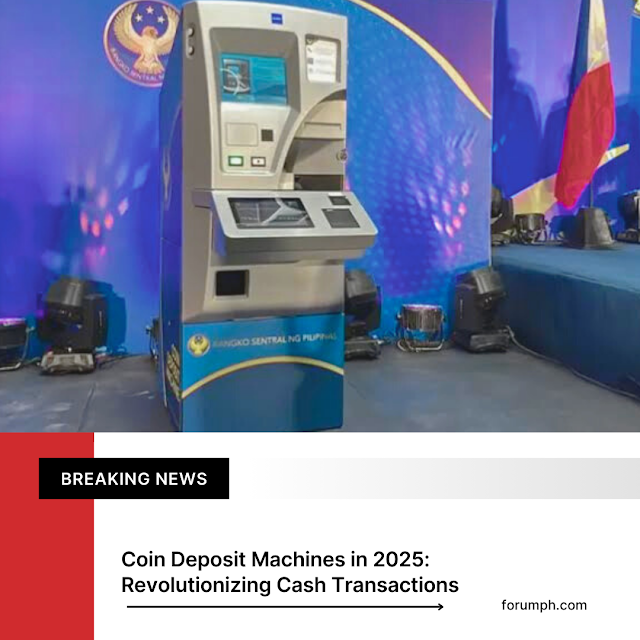

The Evolution of Coin Deposit Machines

Coin deposit machines were initially introduced to address the issue of idle coins—small denominations that often remain unused in households and businesses. Over the years, financial institutions and retailers have adopted CoDMs to encourage coin recirculation, reduce cash shortages, and promote efficient transactions.

Key Milestones in CoDM Development

- 2023: The Bangko Sentral ng Pilipinas (BSP) launched CoDMs in select malls to improve coin circulation.

- 2024: Expansion of CoDMs across major cities, processing over P1 billion worth of coins.

- 2025: Introduction of AI-powered CoDMs with advanced fraud detection and automated sorting mechanisms.

How Coin Deposit Machines Work?

Modern CoDMs are equipped with high-speed scanners that identify, sort, and validate coins. Users can deposit their loose change, and the machine credits the equivalent value to their bank accounts, e-wallets, or shopping vouchers.

Features of 2025 CoDMs

- AI-Powered Coin Recognition: Detects counterfeit coins and damaged currency.

- Multi-Currency Support: Accepts various denominations and foreign coins.

- Instant Digital Transfers: Deposited coins are credited to e-wallets like GCash, Maya, and GoTyme.

- Retail Integration: Allows users to convert coins into shopping vouchers at partner stores.

The Impact of CoDMs on Financial Systems

1. Reducing Coin Hoarding

Many households accumulate coins without using them, leading to artificial shortages. CoDMs encourage people to deposit idle coins, ensuring a steady flow of currency in the economy.

2. Enhancing Cashless Transactions

By converting coins into digital credits, CoDMs support the transition to cashless payments, making transactions more convenient for consumers and businesses.

3. Improving Banking Efficiency

Banks benefit from CoDMs by reducing the need for manual coin counting and sorting, allowing them to focus on higher-value transactions.

4. Supporting Small Businesses

Retailers and small businesses can use CoDMs to manage their cash flow, ensuring they have enough change for daily transactions.

Challenges and Innovations in 2025

Despite their benefits, CoDMs face challenges such as maintenance costs, security concerns, and user adoption. To address these issues, financial institutions have introduced innovative solutions:

1. AI Fraud Detection

Advanced AI algorithms detect counterfeit coins and prevent fraudulent deposits.

2. Mobile Integration

Users can track their deposits and transaction history through mobile apps linked to CoDMs.

3. Blockchain Security

Some CoDMs now use blockchain technology to ensure secure and transparent transactions.

4. Smart Recycling Programs

Governments and banks collaborate to recycle damaged coins, reducing waste and promoting sustainability.

Future of Coin Deposit Machines

As financial technology continues to evolve, CoDMs are expected to become more advanced and widely accessible.

- Biometric Authentication: Fingerprint and facial recognition for secure transactions.

- Expanded Retail Partnerships: More stores accepting CoDM vouchers for purchases.

- Global Expansion: Deployment of CoDMs in developing countries to improve financial inclusion.

Conclusion

Coin deposit machines in 2025 have transformed the way people handle loose change, bridging the gap between traditional cash transactions and digital payments. With AI-powered recognition, instant transfers, and enhanced security, CoDMs are set to play a crucial role in modern financial systems.

%20Redefining%20the%20Mid-Range%20Experience%20with%20AI%20and%20Imaging%20Prowess.png)